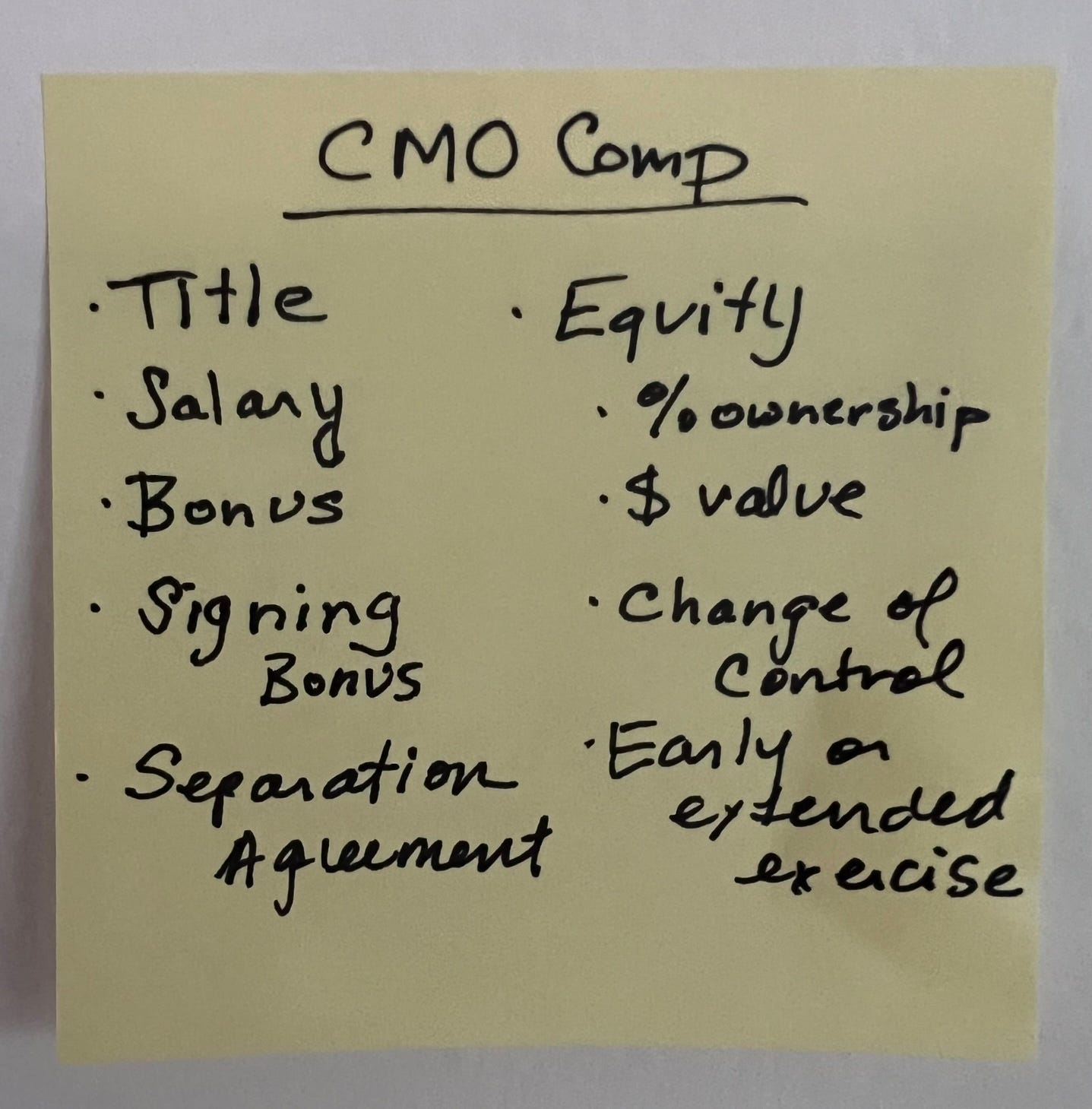

Part 1: CMO Compensation Components

A guide to the components and orders of magnitude

CEOs and investors have lots of data available to them on market compensation for the role they are hiring. As CMOs, we are in a knowledge desert, learning each time we take (and leave) a job. Sometimes we get lucky and a company teaches us something new that benefits us. Sometimes we learn that we really missed out.

A few years ago, I struck out to learn as much as I could about this topic to educate myself and others. Here are some of the learnings. I’m an advisor generally to VC-backed companies $30M - $500M, so the majority of my knowledge comes from that orientation and scale. PE can operate a little differently, bootstrapped and public companies are different still. But many of the same principles hold.

Please take our CMO Salary Survey if you’re a top marketing leader - just 5 minutes of your time. I’ll share back the insights and benchmarks. Thanks!

CMO Salary Components

These are the major components you can negotiate, and my thoughts on each:

TITLE - There are many different titles for the leader of the marketing department, generally conferred by seniority. Head of marketing can be and individual contributor at a tiny company, a director or a VP level. VP of Marketing is common as companies scale, SVP or EVPs of marketing titles are sometimes given when there aren’t other C-Suite members of the executive team yet, if the marketing leader reports to a C-Suite member other than the CEO, or for a number of other reasons the CMO title might not be given fully. Getting the title you want can be an important part of the negotiation - and the indexing of the compensation package. I’ve heard of some candidates who take a lower title with a negotiated timeline and milestones for consideration of the CMO promotion.

SALARY - This is the most understood of all components. Salary is consistent base pay cash. There is some benefit to negotiating more up-front in the instance that annual increases are percentages based on a base. That way your initial negotiation on a salary compounds over time.

BONUS - Bonuses are cash compensation dependent upon meeting success metrics. Sometimes this can be tied to the company's performance metrics, sometimes it’s tied to specific goals you can affect directly. Increasingly CMOs are signing up for more pipeline and revenue goals to be aligned to the sales org. Some are asking for bigger bonus percentages to have more parity with the sales team given the joint sales+marketing motion of up-market sales or the revenue-driving reality of PLG.

SIGNING BONUS - Sometimes you can negotiate a signing bonus, most commonly to offset the costs of leaving your other job to join the new company: unrealized bonus you’re leaving on the table, unrealized options value you’ll lose, moving costs, etc. If they really want you, this is something they do to sweeten the deal for you financially. I’ve heard that it’s hard to get the value of more than one year of unrealized options, but I’ve also heard of some really big signing bonuses. In VC-backed tech, equity can/should/might play a bigger role in your total realized compensation for a role, so you might not want to over-rotate too far on negotiating a signing bonus over other components.

EQUITY - For a VC-backed business, equity *can* be one of the biggest aspects of your compensation. Starting out, it might be 40-50% of your overall comp, but as the company grows (with your help), you might realize even bigger gains on your equity grant. This is one of the most important aspects to negotiate.

What’s it worth? Generally for VC-backed companies, the present value of your options is the difference between the strike price they give you (generally the 409A) and the most recent investor price or “market rate”). If investors recently paid $10/share and your option is being granted for $3, your value is $7 times the number of shares you have.

The CEO will generally run a spreadsheet with scenarios about how much money you will make at 5x, 10x scale to get you excited about a really big number. But that’s all conjecture. You may or may not get there. Historically the current value has been based on the split

Sometimes the CEO might share value projections and not the # of total shares in the pool or ownership percentage. You want this so you can benchmark - they might not want you to have it initially. It is fair for you to ask and get an answer. You can also ask to see the capitalization table and see which investors are on it and who has preferential treatment - sometimes some investors can get all the money first and everyone else must split what’s left, leaving your options worth much, much less.

What’s it worth??? However… At the fundraising high of 2021, some companies got astronomical valuations that far outstripped historic multiples of revenue to valuation. It will take them a long time to grow into those valuations, or they might need to take a down round (take money at a lesser price, indicating the company is “worth” less as a whole). This means the investor price may not be the actual price these days or in the near term. You need to think like an investor yourself (or befriend one) to help you figure out if you think the company is fairly valued and has a chance of growing at its anticipated rate. Read my article 10 Most Important Metrics For Evaluating a Company for more on financial evaluation.

CHANGE OF CONTROL CLAUSE - Many companies get acquired, and many companies get sold to other investors. A change of control clause protects you by accelerating the vesting of your options in the instance of one of these big changes. There are two main types:

Double Trigger - This is the most commonly granted change of control - it relies on two triggers, first a change of control and a significant change in your job title, responsibilities or other factors negotiated. If both of these things occur, your equity will often vest immediately instead of over the previous window negotiated (often 4 years of tenure). Sometimes you can negotiate for all of your equity to vest, sometimes just some of your equity. I’ve been through 7 acquisitions. I wouldn’t take a job without a double trigger at least, because often they don’t need a CMO in the new company, or they will be significantly changing strategy without a small acquisition leader being on their leadership team.

Single Trigger - In a single trigger scenario just the change of control can trigger the accelerated vesting of your option. Companies don’t like this as much because it’s a big cost to any potential acquirees, and potentially makes the executives less likely to stay with the new company (if they ARE wanted

EARLY EXERCISE - One special executive term that I just stumbled into was an early exercise. In this scenario, you can buy your shares immediately even though they haven’t vested. The benefit of this is that if you buy them immediately at the granted price, there is no immediate tax implication, and when you sell them down the road, you will be able to sell at a capital gains tax rate instead of ordinary income rates. Depending on your income in the year you sell, this could be more than 15% gain. There are pros and cons to early exercising. In some cases you have to buy it with your own cash - that’s real money you’re giving a company that may or may not be successful and return your money! There is also an opportunity cost to having that money in your company instead of another investment which might do better, or diversify your risk.

Promissory Note / Cashless Exercise - One workaround for the opportunity cost issue is a cashless exercise. In this scenario, the company lets you buy the options without paying them through a company-granted loan. They keep the equity as collateral and you are committed to paying down the road. The advantage is that you don’t have to find the money now to get the exercise and tax-saving advantages. The disadvantage is that you owe real money they will come to collect at the end of that period (when the investment still might not yet be liquid)

EXTENDED EXERCISE - Extended exercise is the opposite of early exercise. It’s the right to not exercise your option until later. Generally, an executive who leaves gets 3 months to exercise, some people are able to negotiate 1, 2, or in some amazing cases 5 years to exercise. We would all love to wait to see if a company is successful before putting out money or taking financial risk. Extended exercises are amazing, but much less common. Companies don’t like them because they want the equity back if you're not going to actually buy it to entice new employees to join, contribute, and add value. SOMETIMES CMOs are successful at negotiating an extended exercise as they are leaving, but you don’t have as much leverage at the end as at the beginning in most compensation negotiations.

SEPARATION AGREEMENT - This is a term that specifies what compensation you will receive if you choose to depart ways. Generally, if it’s “for cause” and you did something really wrong, they don’t have to give you anything significant. If it’s not “for cause” you *can* negotiate terms like 3-6-12 months salary, pro-rated bonus for the period you were there, healthcare for 3-6-12 months, etc. If you don’t have a negotiated term, they can give you whatever they deem appropriate. Perhaps 2 weeks. It takes many CMOs 3, 6, or 12 months to find another great CMO role. The right separation package is part of an overall compensation package that gives you the courage to leave your safer job and take a risk on this new company, knowing you’ll have upside if you’re successful together and a little space to find something else if you’re not.

Want more detail? Read Part 2 VC-Backed CMO Compensation to see the specific ranges and trends I’m seeing in the market. Subscribe to my blog to get all of my latest thoughts and research in your inbox.

Always love your insights and thoughts on this topic. Your session over a year ago was still one of the most informative sessions on this topic I have ever seen.

I saw your talk on Friday and this is an amazing follow-up. Thank you. Do you have similar insights for taking on Advisory roles? I've been approached several times and the terms are wildly different. What should we be asking for? Thank you so much for sharing this knowledge!