10 Most Important Metrics For Evaluating a Company

Why Candidates Should Think Like Investors

The momentum of the company you work for is one of the greatest contributors to your career growth - as or more important than how hard you work or how bright you are. Work for a growing company? You can grow your career with it. Work for an exceptional company? People will want to hire you to get your knowledge. Working for a great company is like a winning lottery ticket of sorts: early Apple, Facebook, Google, AWS, Salesforce… So many of these companies have been career-defining for people who got there at the right place and right time and did exceptional work. But outside of going to the current leaders, how do you pick an exceptional company? Especially in this market?

I fell into an exceptional company at Atlassian thanks to some colleagues I had worked with earlier in my career. I trusted their judgment, made a leap, and won my own lottery ticket. But after Atlassian, I went to a company that wasn’t a lottery ticket. We had oversold a PE investor, we had execution problems, and we ended up cutting the company until selling. I wondered… “How do you pick your next Atlassian?” For several years now, I’ve been researching and market-testing that question. I have come up with 10 metrics I think help you have a better chance. This list is based on my experience in SaaS B2B startups → Post IPO companies. Evaluating a public company or B2C companies are related, but might warrant a different blog.

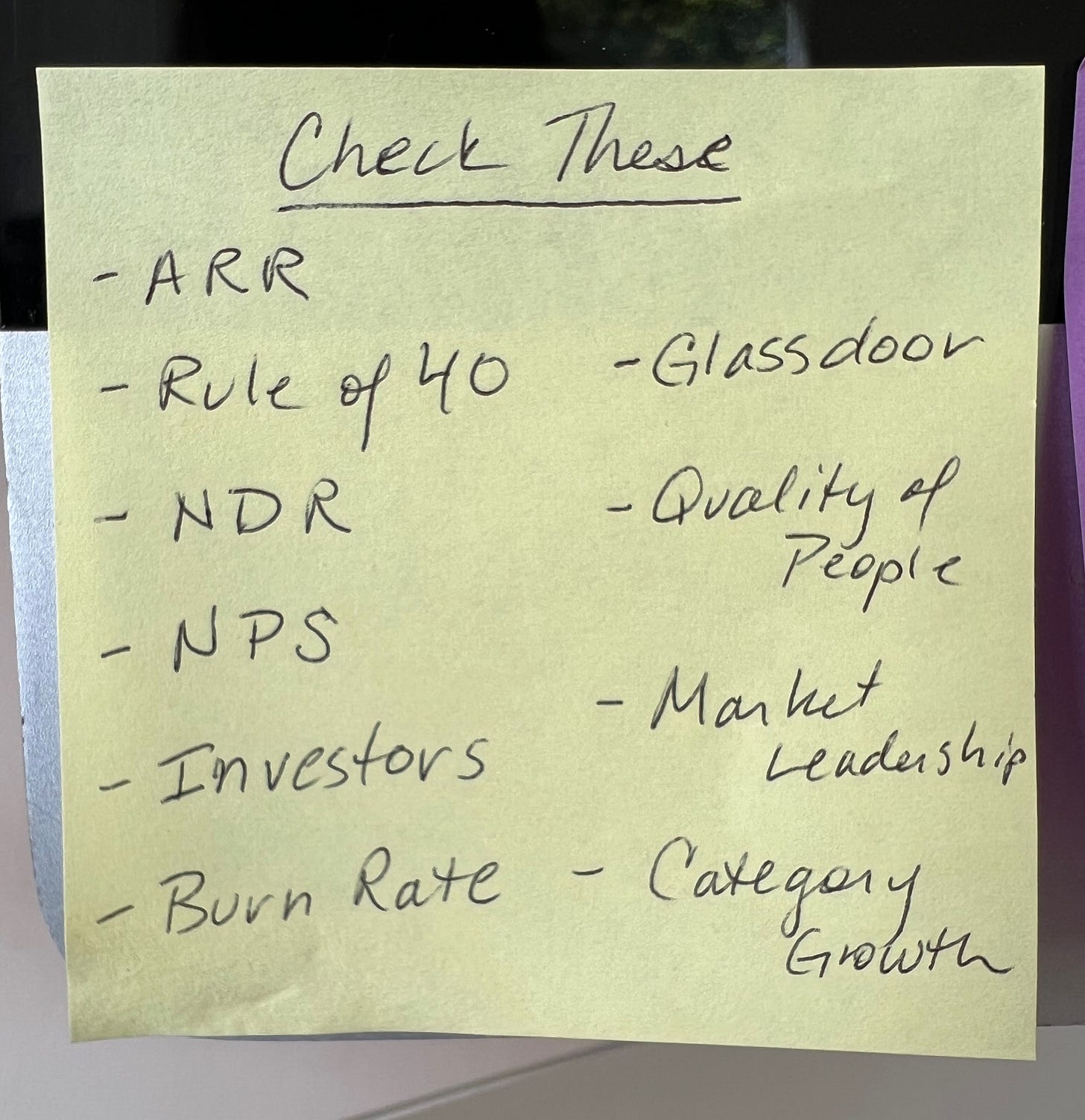

Checklist for evaluating a company:

Read on for details on each:

1. Overall ARR

The overall annual recurring revenue (ARR) of the company is a big factor in how your experience will be at the company. Big companies offer more stability, and small companies more risk but more upside. If you’ve been in a stable environment, you might overestimate how much risk small company employees endure. Early-stage startups are a roller coaster ride - they are still trying to find product-market fit, they may drastically change directions, and they are often all hands on deck fighting for survival and payroll. Joining a pre-revenue company vs. $10M. vs. $100M vs. $500M are very, very different experiences. Each revenue bar is a significant milestone of a greater chance of success, greater stability, and often greater business sophistication of the team members. Picking your swim lane in revenue is the first big trade-off you’ll make.

2. Rule of 40 / Growth

In the past, we all wanted to know the growth of a company to measure its momentum. 40%+ was the bar for hypergrowth, a company growing 30% was often “better” than 10% (though scale must be considered.) These days, growth + efficiency is the important metric. VCs have long discussed the Rule of 40 as an indicator of this combination (Specifically, the rule is based on adding the growth rate + profit margin. Companies having 40+ are generally in the top quartile of companies.) Atlassian’s growth was less than some of the high fliers at 30-50% depending on the year, but the company was PROFITABLE. It’s possible to be 40+ with a high loss, but the growth has to be BIG 60%, 90%, 100%, 200% to counter-balance. This year investors want profitability to be on the within-reach-horizon. Growth is great, but it’s critical to understand at what cost growth is being achieved.

3. Net Dollar Retention

Net Dollar Retention (NDR) is one of the best ways to see if a tech company is healthy and growing. It measures the expansion or contraction of a company's existing customer revenue over a given period. NDR takes into account the revenue lost from churn and increased revenue from upselling, cross-selling, and renewals from existing cusomers. If a startup's net dollar retention rate is 120%, it means that, on average, the company is expanding revenue in its existing customer base by 20% annually. A high NDR is 120+ for B2B. Snowflake had one of the highest NDRs at 158% at its IPO. B2C NDR is usually lower than B2B because B2C experiences more churn. A healthy NDR means customers love the product and are buying more. Like all numbers, it’s the comparison to experts / options that tells you if they are good or bad in the current market.

4. NPS / CSAT / Customer Love

Companies with wildly happy customers (Zappos in the early days for instance) get the benefit of all of their customers selling the product to others. This drives above-market growth at an efficient cost since you generally don’t pay all of those brand evangelists. Jay Simons, 9-year president at Atlassian, joined when it was sub $30M in revenue because of how often he heard from customers who loved the Atlassian products in his previous job. Top VCs interview dozens of customers before investing in a company - candidates should try to talk to customers too to see how much love is there.

Another way to track whether or not the customers love the product is through Net Promoter Score numbers. This is the measurement of how many customers would refer you to others based on their experience. Numbers range from -100 to +100. But above +50 is considered excellent. Atlassian’s brand NPS when I was there was 65+ and ranged from 15→ 40 for different products. Some companies measure NPS, some Customer Satisfaction from customer support. Basically, you need to figure out if customers are happy or unhappy as a leading indicator of whether the company will grow quickly. Customer love (for a great product) is a huge driver of long-term success and a good bet for your career.

5. Quality of Investors

For private companies, one metric of “is this a good company” is the quality of their investors. Higher growth companies are more often VC-backed, lower growth / higher efficiency companies are more often PE-backed, some are boot-strapped (they use their own money), and some are family-funded. The VC and PE route give you some extra context into how top financial companies have evaulated the company. The best VCs get to pick the best of the best companies more often - the VC themselves offer a validating mark of prestige, fosters introductions to new customers, and introductions to top-tier candidates from their portfolio. Forbes compiles a “Midas List” of the top VCs in any one year, and there are several articles measuring the top VC firms by Assets Under Management (scale) here, here, and here that give good directionional data on top firms. From a career perspective, getting into a top-tier VC can give you more opportunities down the road if you’re successful. They frequently refer past candidates from their portfolio to new portfolio companies. It’s also better to look at the recency of the investors’ investments - sometimes a company was really hot early with top investors, but as performance slowed, later investors were less prestigious. Also, as with any of these, there are great companies that may be outside of this framework — but directionally it’s a helpful tool in your triangulation.

6. Burn Rate / Timeline

If you’re looking at smaller tech companies, it’s really important to understand their burn rate or how fast a company is spending funds. Companies should ideally have money on hand to survive several years, even in unexpected circumstances. Smaller companies often have less of a runway. In the past, companies had higher burn rates and ran at shorter time-to-run-out timelines chasing after growth. They could do this because they could raise more money easily if the money started to run out. With the current tight economic market, it is no longer as easy to raise money. You want to make sure a company can survive for a few years even with unexpected surprises. The stress of a company missing payroll, and laying off some / many is a stressful and sad outcome.

7. Glassdoor CEO and Company Ratings

When I was a CMO, we would complain about unfair Glassdoor ratings by disgruntled employees. It’s true that a few bad apples can bring down the number unfairly, or that a small population of Negative Nancies can have non-statistically significant impacts. HOWEVER, over time and scale, I’ve seen that Glassdoor ratings be directionally accurate. Fantastic CEOs / companies that you’d enjoy working with, generally have higher ratings than shit-show CEOs / companies. Worth checking.

8. Quality of colleagues

I spent a month or two talking to a bunch of VC about what metrics they use to evaluate companies. They gave me many of the same metrics on this list — but what surprised me was that they actually over-rotated more than I would have thought on the PEOPLE. Their confidence in the CEO, the top leaders, people they knew or had worked with before was a huge driver of their final decision to invest. For me personally, a few companies that pulled the most elite, ambitious employees helped define my career. I once decided between two jobs with the question “in 10 years, which group of colleagues will I be calling for career advice?” I chose the job with the “better” colleagues and it has made all the difference. Great colleagues help you grow in your knowledge, your job, and they go on to other great companies where they might take you along.

9. Market Leadership

It’s not always possible to see how a company ranks in their market leadership (some smaller or newer products / categories are not yet benchmarked). But for many companies, you can see ratings of their products on Gartner, Forrester, G2, Trustpilot, and other rating sites. If you had a choice between two companies and one was a leader and one was deep in the pack, all things equal, you’d pick the leader. I worked at Oracle for many years where Larry Ellison professed “the #1 company in the market makes almost all the money, everyone else shares the crumbs.” It’s possible to have a great career at a fast follower #2, and many markets are constantly shifting. But leaders often have snowball benefits as they have more money to invest in great products, more great customer references, more amazing people that want to work for them etc.

10. Size and Growth of the Market Category

Just after I left college, I read “The Millionaire Next Door.” A key passage that has aways stayed with me is that antique stores made a profit of something like .5-3%. and oil and gas companies made a profit of something like 35-55% (my memory of numbers in the book is 20 years old, so take this as directional). The BEST antique store might make 3% profit and the very WORST oil and gas company would make 35% profit The category you chose really matters. Investors and CEOs often look at the Total Addressable Market (TAM) and the growth of that market, often the Compound Annual Growth Rate (CAGR). If you’re in a big market, you have the chance to grow more than if you’re in a much smaller market. If the market itself is growing while you are in it growing, your growth can be accelerated vs. other parts of the economy. Understanding if the company you’re interested in is in a big market space that’s growing will help you pick a better company. Snowflakes’ CMO Denise Perrson chose Snowflake because data management was such a big problem. Her bet paid off as she helped grow Snowflake from startup to $55B in market cap. An equally strong early-stage startup without that market potential may not have had as much upside.

Warnings for Managing Your Career by Picking the Right Company

The data above helps you get a sense for a company’s momentum, as you talk to more companies, you’ll be better able to compare the metrics of different companies against each other to evaluate your options. But at the end of the day, you’ll need to make your own calculations to make the decision of if it’s worth it to you. A few warnings for the wild ride:

Experts’ opinions are still just opinions

Most elite people seek the advice of others in making big decisions. Ideally, you know someone inside the company that you trust, that has your best interest in mind that can give you good advice. You may talk to investors who have selected the company or passed on it. You may talk to peers in the industry to give you advice on the category. It’s great to collect expert opinions. It’s possible that you don’t take some advice seriously enough and make a mistake (I have). But it’s also possible that you pass on an opportunity because of advice from experts that’s a big miss (I have). One CMO I know trusted an old boss who gave her advice to pass on a job so his firm could hire her - and the pass was a big miss. It’s tricky to thread the needle of taking advice and not overvaluing it vs. your analysis. In the end, you need to groom your intuition and trust in it the best you can.

Either way, it’s still a gamble

Even if you do your best to join a company with all the best metrics, each company is still a gamble. All companies go through massive ups and downs over the scope of their journey and encounter unexpected rough-patches. It’s hard to decide when to stay and when to go, when to chase new opportunities, or when to wait it out. But even most VC portfolios still fall victim to the Pareto principle where 80% of the results come from the top 20% of the portfolio. The professionals at picking are only right a small % of the time!!! Staying in the game, doing great work, and meeting exceptional people will help you keep getting more at-bats.

Make the Best Decision You Can With the Information You Have Available

Navigating a career is a tricky game of constant decisions. At each stage, we’re a little bit wiser from the lessons learned and scar tissue of the past. I’ve found this list of 10 metrics to be helpful in getting to know different companies and for thinking about my career like an investor thinks of investments. Investors get to pick portfolios of a dozen or more companies and diversify risk across that group. As employees, we pick one huge investment of our time at a time and may only get 5-10 such investments in our lifetime. Continuing to understand how to evaluate opportunities vs. one another gives us a better chance to make the best decision we can with the information we have available.

What did I miss?

This is a fantastic article benchmarking many of these numbers for public companies: https://substack.com/home/post/p-149718363. I love @Jamin Ball and @cloudedjudgement

Appreciate this deeply researched and thoughtfully presented article. These 10 metrics definitely resonate well with me. One thing to add is to know if one is working in a Cost vs Profit Center as per the company delineation. Depending on the company/vertical they play in, the challenges one will need to overcome will vary widely. For example, the challenges from being in the Product org in a Platform Team at a Cost Center like IT/SRE like Axon vs Growth/Profit Center like Twitter/Yelp are night and day.