How to Measure Brand’s Impact on B2B Pipeline

Why attribution fails, and incrementality makes brand defensible

73% of leaders believe brand influences demand, yet only ~28% can actually connect brand to pipeline.

Most marketing leaders want to invest more in brand, but can’t defend it with data.

After the response to last week’s post, “Brand vs. Demand Isn’t a Budget Fight. It’s a Measurement Crisis,” I asked Pranav Piyush, CEO of Paramark, to weigh in. Measuring impact is his company’s focus, and it’s the missing link for unlocking brand investments. Thanks, Pranav, for writing this:

Why “brand is hard to measure” is wrong

Most teams say brand is hard to measure. That’s not quite true. Brand is hard to measure with traditional methods like touch- or click-attribution. First-touch, last-touch, and multi-touch all suffer from the same problem.

Brand investments, TV, online video, earned social, creators, sponsorships, don’t usually push people straight into your funnel. Very few buyers click an ad, fill out a form, and convert on the spot. Instead, brand creates mental availability. People notice you. Remember you. Trust you. And when they’re ready to act, they don’t click, they search. They ask peers. They type your name into Google or ChatGPT.

So, by definition, the touch-based-attribution game is rigged against brand.

Brand almost always loses, not because it didn’t matter, but because brand rarely shows up as a click, a form fill, or a last touch.

You need a measurement framework that puts all investments on an equal footing.

There’s a different question we can ask: “What would have happened if this investment didn’t exist?” That’s incrementality. And this is where brand starts to look measurable.

Practically, this means using econometrics and experimentation to understand the causal impact of brand and demand investments on pipeline, revenue, and efficiency. This approach has been common in consumer marketing for years. It’s now becoming much more viable in B2B.

How to do this for your own brand

Over the last couple of years, my team and I have worked with top B2B SaaS brands on exactly this topic. After analyzing billions in marketing investments, here’s a foolproof method to measure the impact of your brand.

Step 1: Align on the measure of success

Before you build any experiment or model, define what success looks like. Brand investments don’t directly translate into revenue in the short-term. You have to translate them into leading signals that predict future revenue. In B2B when consideration cycles are longer, you don’t have months to wait to understand or demonstrate the impact of your marketing efforts.

At a high level, there are two levels of measurement you should consider:

Campaign-level impact: Did this specific campaign move top-of-funnel metrics?

Holistic business impact: Did your brand channels improve pipeline growth?

While it’s tempting to only measure top-of-funnel with metrics like awareness and consideration collected through surveys, we recommend behavioral metrics like search query volume or ICP traffic to your site. This removes all types of bias and inaccuracy present in survey-based metrics.

It’s also tempting to only focus on revenue metrics, but that’s often a mistake. If your consideration cycles are long, as they usually are in B2B SaaS, it might be weeks or months before your marketing investments show up in your revenue metrics.

Step 2: Form a testable hypothesis

The core idea here is incrementality: you are not trying to see whether brand “gets credit” in last-touch attribution. You’re trying to see what changes when brand investment is present versus when it’s absent.

Example hypothesis:

“If we increase brand spend this quarter, we will see an improvement in traffic and sales-qualified-opportunities (aka pipeline) compared to a period or region without brand support.”

This sets up a falsifiable, causal statement that you can design a measurement around. The key is having a credible counterfactual. What did demand look like with sustained brand investment, and what did it look like without?

Here’s an example of what this looks like:

Step 3: Set up an incrementality test

Now, you’re ready to put this hypothesis to a test with an incrementality test. There are a few ways to structure this:

Geo-tests: Run your brand campaigns in some regions but not others.

Control vs test groups: Treat some audiences with brand campaigns and others without, holding all else equal. This only works for owned channels where you can neatly split your audience into test and control groups.

Time-based tests: Compare performance before, during, and after sustained brand investment. (Sometimes has an issue of other outside factors)

These approaches help you get at causal impact, not just correlation.

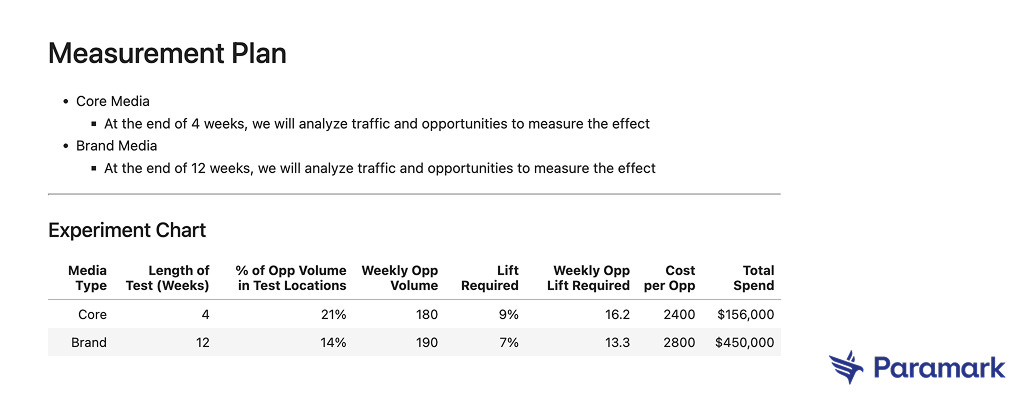

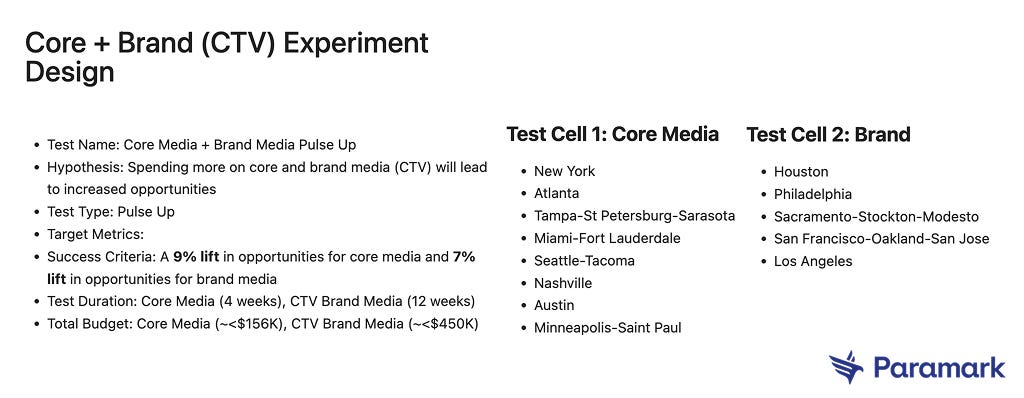

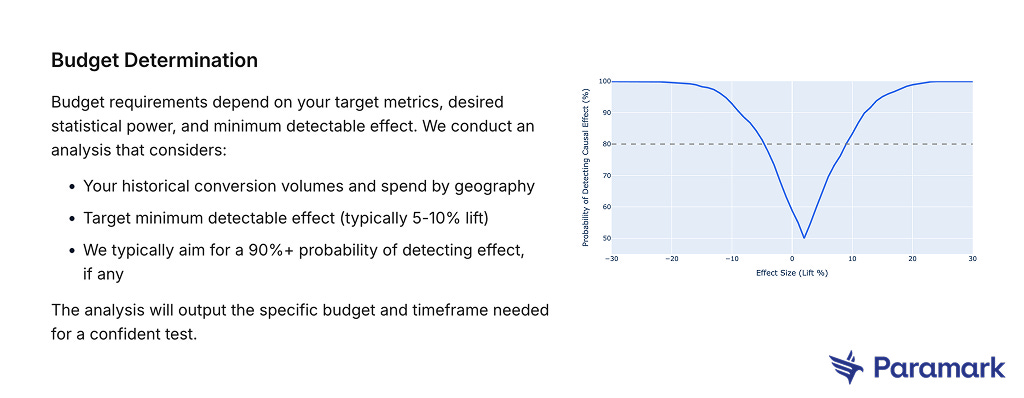

One of the biggest mistakes teams make is expecting instant results from brand investment. A proper test requires weeks or months of setup, depending on your exact hypothesis and volumes. Below is an example of a statistically valid test design for a top B2B brand we work with.-

In addition to platforms like Paramark, there are various open source methodologies (MarketMatching, CausalImpact, GeoLift) that allow you to design statistically valid incrementality tests on your own.

Step 4: Combine incrementality with holistic modeling

If your data volume and tooling allow, you should also layer in Marketing Mix Modeling (MMM) to estimate how different channels contribute to outcomes over the long run. MMM and incrementality tests answer related but distinct questions:

Incrementality tests help you see what happens when you change brand spend at any given point of time.

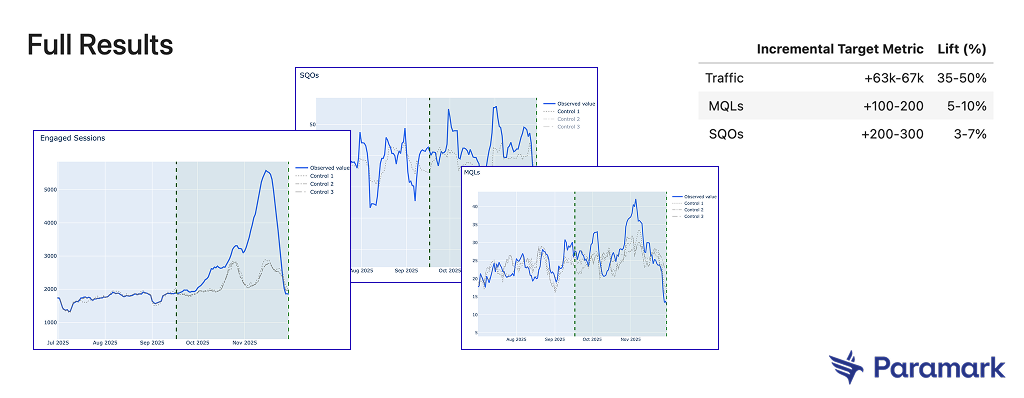

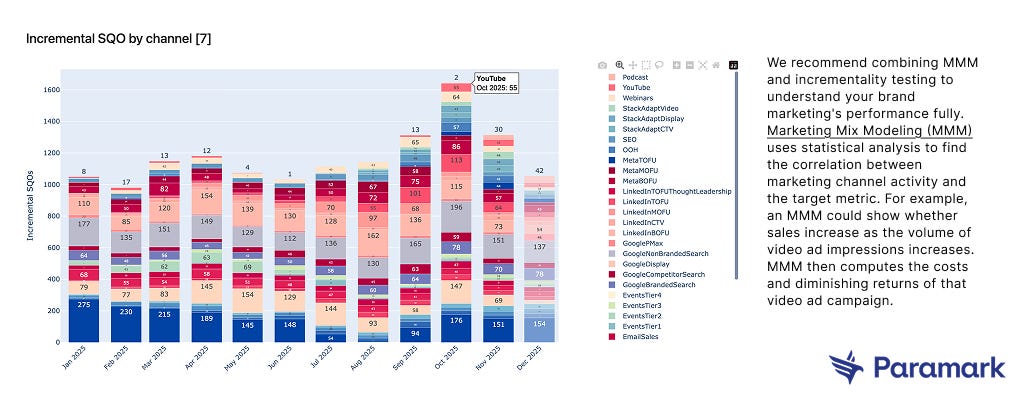

MMM helps you see the impact of those brand channels over time based on your historical data. In the example below, you can see how YouTube, OOH, Podcasts, and events are on an equal footing with search, email, and other direct response channels.

Together, they bring rigor to your measurement strategy. Once you have results, whether from geo-tests or modeling, the final step is narrative:

Don’t just show the numbers. Tell the story:

“When brand was present, pipeline grew by X%.”

“In test regions with brand campaigns, CAC decreased while pipeline grew faster.”

“Direct traffic and branded search share increased, supporting higher mental availability.”

This is how brand goes from nice to have to defensible.

One final note. AI doesn’t change anything fundamental about this approach, but it changes how much more affordable it is to do this in practice. Incrementality used to require heavy data science and long cycles, which put it out of reach for many B2B teams. AI and ML lower that barrier by automating data ingestion, model updates, and pattern detection, making it possible to see directional impact much faster.

Tools like Paramark use AI to continuously analyze marketing and business data, helping teams understand how brand investment changes demand efficiency, pipeline, and cost curves — turning incrementality from a theoretical ideal into something operators can actually use in planning.

What’s a possible impact?

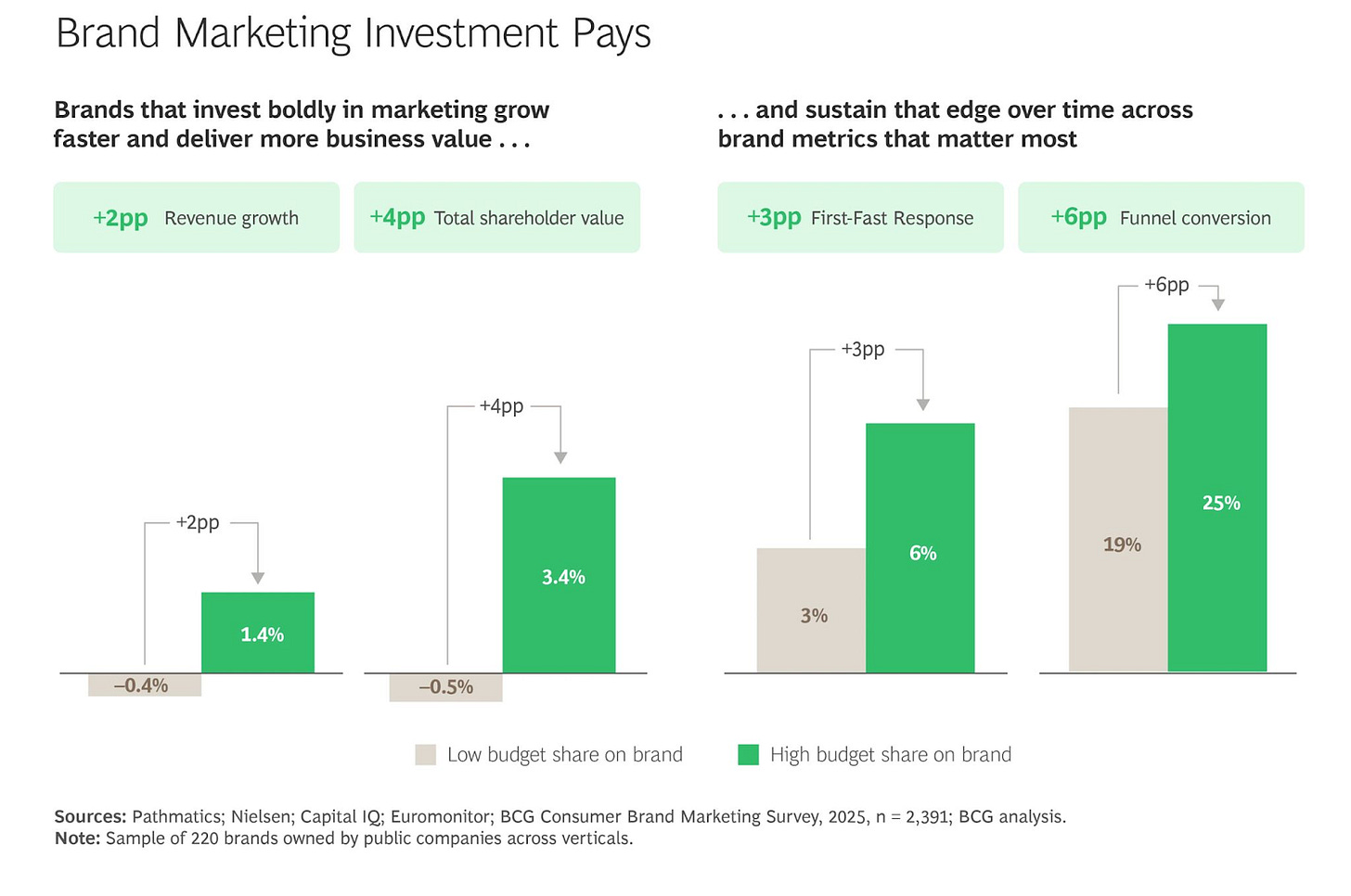

Uplift from brand investments is, of course, dependent on the amount of spend relative to the target audience and duration, but a brand analysis by BCG found that companies that invested in brand and sustained that investment saw: +2% increase in revenue,+4% boost in shareholder return, and +6% increase in funnel conversion:

When Paramark runs tests with customers, they are often looking for (and see) a lift of more than 7-9% against a control group in opportunity volume.

When this starts to make sense (and what to do if you’re smaller)

It’s worth pausing here to recognize that this approach doesn’t magically work for every company, at every stage. Incrementality requires scale. Typically, companies spending north of a few million dollars/year are good candidates for incrementality measurement.

If you’re running a large enough business (meaningful spend across multiple channels, significant demand volume, consistent brand investment), then asking “what would have happened without brand?” is not only reasonable, it’s one of the most important questions you can ask. A modest improvement in conversion rates or cost per opportunity can materially change growth economics. That’s where incrementality measurement really earns its keep.

But if you’re earlier-stage, the reality may look different.

Volumes are lower. Noise is higher. You might run a brand campaign and see… nothing obvious happen. Not because it didn’t work, but because the signal gets lost in week-to-week variability. In those moments, trying to force the same level of rigor can feel frustrating, or worse, misleading.

That doesn’t mean brand doesn’t matter yet. It means how you measure it has to evolve with you.

For smaller teams, the goal isn’t to prove causality with precision. It’s to build directional confidence. You’re looking for patterns and even earlier leading indicators.

You notice that inbound conversations sound different after a brand push (Gong used to track mentions via Gong recordings). Outbound reply rates tick up (use the time-based experimentation framework). People seem to already “know who you are” when sales engages them. Branded search slowly becomes a bigger share of traffic. None of these signals are definitive on their own, but together, they tell a story about momentum.

The mistake smaller companies make isn’t that they can’t measure brand perfectly. It’s that they don’t measure it at all, or they try to force it into last-touch attribution and conclude it doesn’t work.

The better move is to start with the right mental model early: brand is measured at the system level, not the channel level. Even if your tools and data aren’t sophisticated yet, that framing matters. Looking at aggregate search query volume or how overall traffic is trending may be a sufficient first step.

Because when scale eventually arrives, when spend and demand volume increases and efficiency starts to matter as much as growth, you’re not suddenly changing how you think about brand. You’re just upgrading the rigor of how you measure it. Incrementality isn’t a switch you flip one day. It’s a curve you grow into.

And the teams that navigate this well are the ones that treat brand measurement as something that matures alongside the company, not something you postpone until the arguments get uncomfortable.

The question we should be asking

The most important shift in “winning” the brand investment challenge is narrative.

The wrong question is: “What’s the impact of brand?”

The better one is: “Are we measuring brand the right way?”

Because when brand gets cut, demand doesn’t fail immediately. It just gets more expensive. Slower. Harder. Less predictable. By the time teams feel the impact, the decision has already been made, and the cause is rarely obvious.

The data shows leaders already know brand matters. The opportunity now is to close the gap between belief and behavior. Not by turning brand into performance marketing, but by measuring it in ways that reflect how it actually creates value.

Because this was never a budget fight. It was a measurement crisis.

And once you see that, the path forward becomes a lot clearer.

Carilu Dietrich is a former CMO, most notably the head of marketing who took Atlassian public. She currently advises CEOs and CMOs of high-growth tech companies. Carilu helps leaders operationalize the chaos of scale, see around corners, and improve marketing and company performance.

Thank you Carilu and Pranav on this excellent article. In addition to measuring how brand spend impacts performance, how would we go about showing that it actually drives a more efficient GTM / lowers overall CAC?

I’m looking to head-off the financial argument of: “sure it increases pipeline, but is this the most efficient way to do that?”

just grateful you are writing about the things that matter for marketers. and you do so in a clear, concise way that gets everyone to just nod along and get back to work with better tools/strategies