Brand vs. Demand Isn’t a Budget Fight. It’s a Measurement Crisis.

What 168 B2B CMOs revealed about why brand often loses

Brand and demand have competed for marketing budget forever. But now, buyers are harder to reach, paid ads are getting more expensive, categories are noisier, and trust is harder to earn. I was hearing that CMOs were investing more in brand and wanted to see the data.

Huge thanks to Ray Rike and his BenchMarkit team, and my collaborators Jon Miller and Bill Macitis. Together, we surveyed 168 B2B marketing leaders for the 2026 B2B Brand vs. Demand Marketing Benchmark Report.

The results highlight a paradox many of us feel acutely. Highlights of the data are below, and you can see a full interactive site and benchmark yourself vs peers here

Highlights:

The current reality: demand dominates

The desired future: brand matters more than budgets show

The real blocker: measurement

AI-native companies are leaning into brand

The current reality: demand dominates

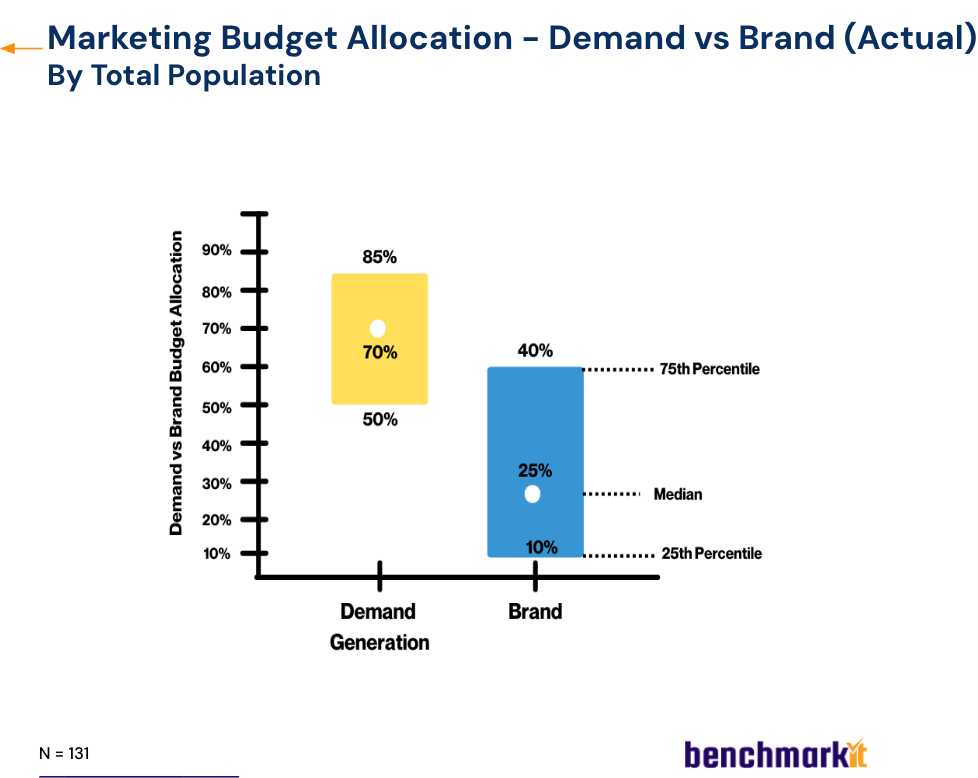

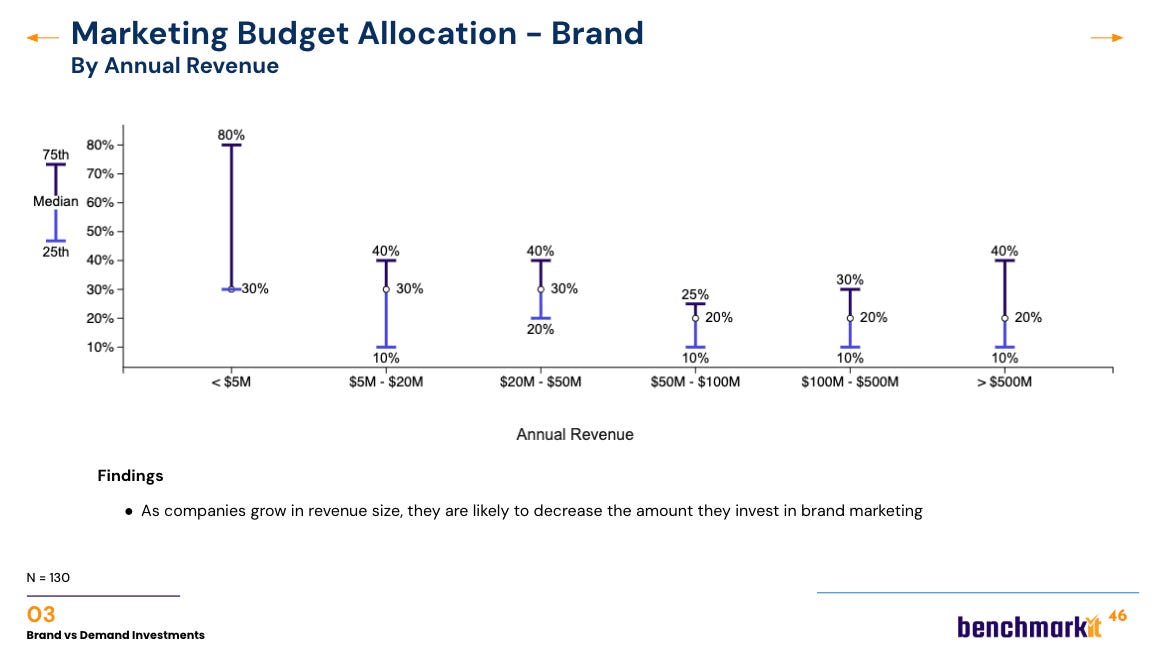

Today, the median marketing budget allocation is ~70% demand generation and ~25–30% brand.

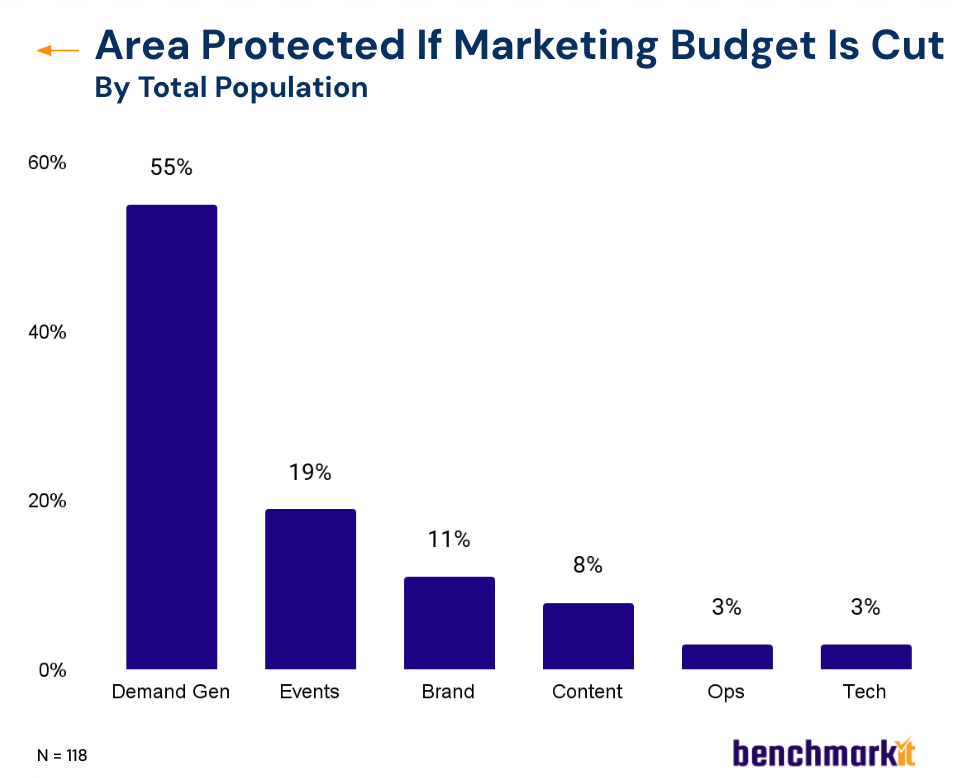

Pipeline pressure is intense, and when budgets tighten, demand gets protected. 55% of leaders say they would fight hardest to preserve demand spend if cuts were required. Only 11% would protect brand.

This isn’t because leaders don’t believe in brand.

The desired future: brand matters more than budgets show

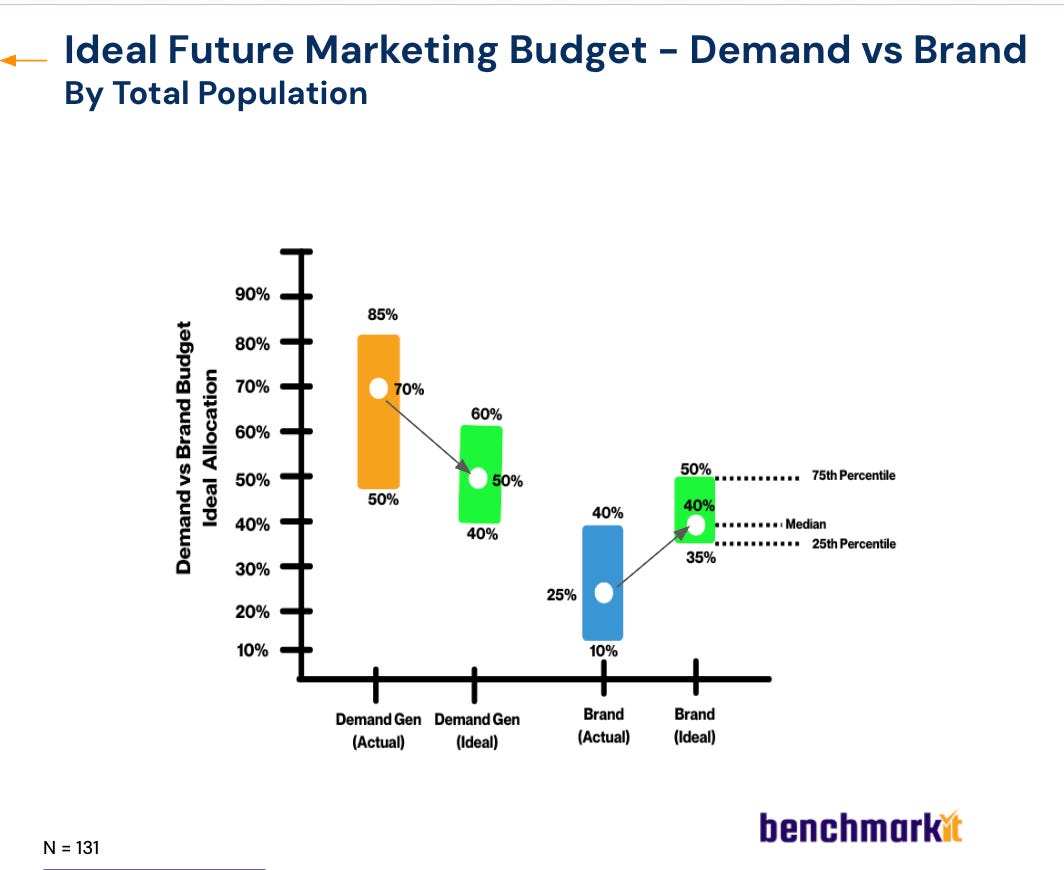

When asked about the ideal mix, CMOs told a different story: 50% demand / 40% brand.

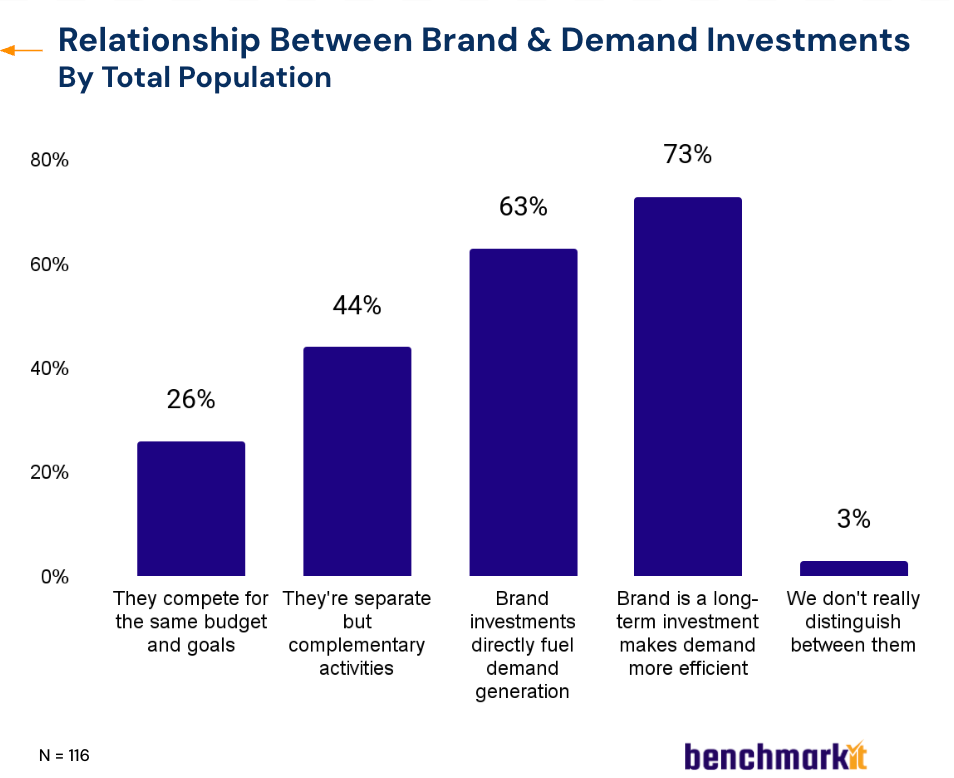

Even more telling, 73% believe brand investment makes demand generation more efficient, and 63% say brand directly fuels demand.

Belief is not the problem.

Measurement is.

The real blocker: measurement

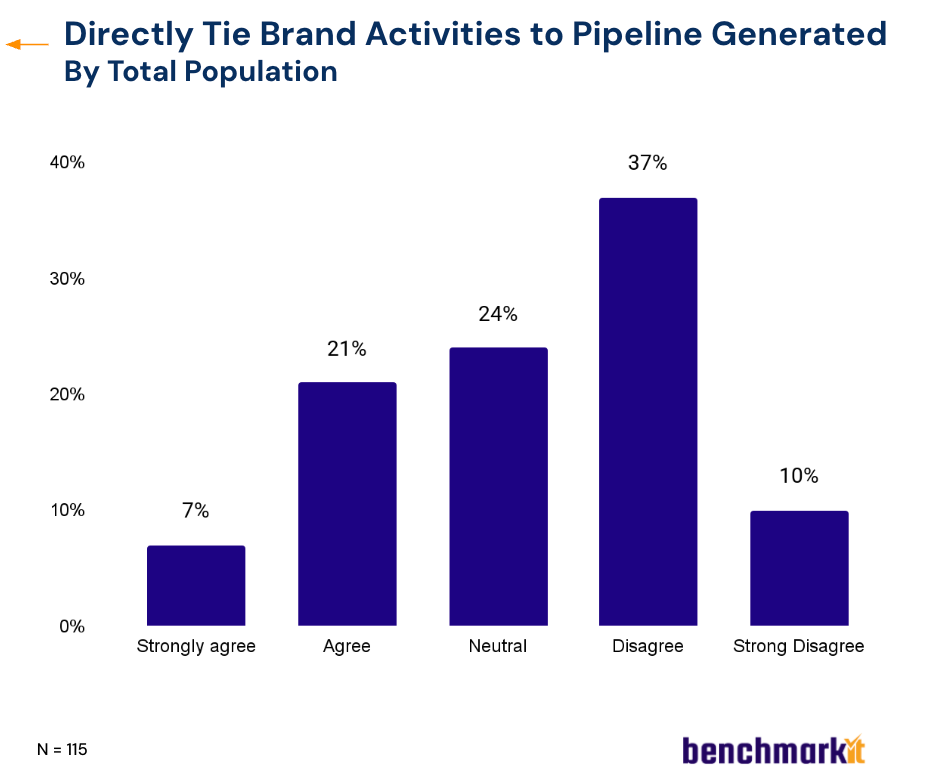

Only 28% of companies can directly tie brand investment to pipeline.

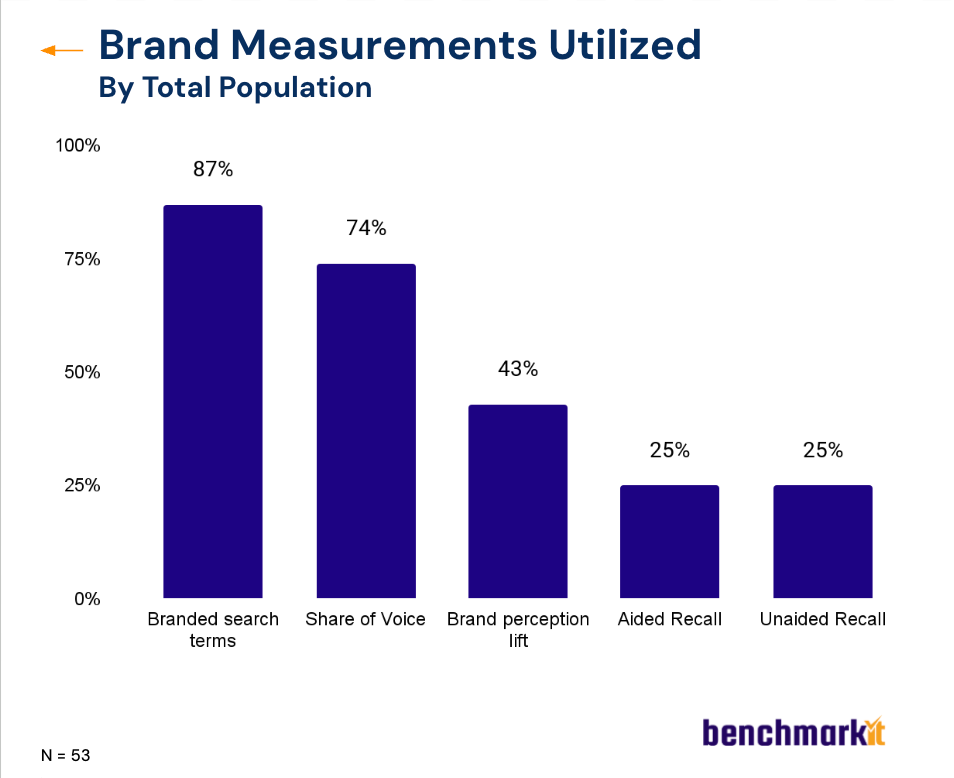

As a result, brand ROI is often measured using proxies like website traffic or branded search, useful signals, but not enough to defend brand in a CFO or boardroom discussion. Plus new changes in LLM search behaviors are affecting website traffic in ways unrelated to brand spend - undermining its measurement effectiveness.

This creates a vicious cycle:

Brand is under-measured → brand is under-defended → brand gets cut first → demand efficiency suffers → pressure increases.

What AI-native companies are revealing

One pattern I’m seeing alongside the data is worth clarifying.

Many AI-native companies appear more brand-forward, but it’s not because they’ve discovered a new playbook or abandoned demand. In most cases, they’re operating in markets with extraordinary inbound demand. Buyers are already searching, experimenting, and self-educating.

That changes the job of marketing.

Instead of manufacturing demand or aggressively capturing it, these teams are focused on shaping perception, earning trust, and standing out. The heavy investment shows up in brand investments: rich product design, clear narrative, founder-led social, video, YouTube, influencer collaborations, and high-visibility experiences.

Our data actually suggests this isn’t an “earlier stage” phenomenon. Early-stage founders have always invested heavily in brand. What’s different here is percentage of budget and intensity of focus at AI-native companies, enabled by strong market pull.

Our data isn’t broken out by AI-Native and non AI-Native, but shows clear brand priority in early revenue stages:

*see more breakdowns by company size at the full interactive benchmark report here.

The takeaway

Most marketing leaders believe in brand.

They just don’t yet have measurement systems to prove it’s directly contributing to revenue. Longer B2B sales cycles, with many people on the buying committee and many touches over many months, make measurement an ongoing challenge. Massive changes in website traffic and behavior are making the most-common brand measurement unstable.

Until brand is connected more effectively to demand efficiency, pipeline velocity, and revenue durability, it will continue to lose budget battles, even as leaders know it’s essential. Perhaps something I’ll explore in an upcoming newsletter : )

Want more data? Marketing Budget Survey Live

Ray Rike and team are launching a 2026 B2B Marketing Budget and Productivity Survey. We need your help! Please consider taking a 6-minute survey here. We’ll explore how AI is changing budgets, if headcount %s are going down and what trade-offs your peers had to make this budget season. If you take the survey, we’ll share back the insights!

Carilu Dietrich is a former CMO, most notably the head of marketing who took Atlassian public. She currently advises CEOs and CMOs of high-growth tech companies. Carilu helps leaders operationalize the chaos of scale, see around corners, and improve marketing and company performance.