Allocation Models: The C-Suite Imperative

Clarify priority or risk chaos

“The president said enterprise sales is the absolute priority for marketing, and we should spend all our time and energy there. But then the CFO wanted to dig into results for direct sales, emphasizing how important it is as well. What am I supposed to do?” a marketing leader confided.

"How does the revenue of the two areas compare?” I asked.

“80/20,” she replied.

“And growth?” I followed.

“Enterprise is slower growing; direct growth should be double or triple,” she replied, and we discussed the nuance.

“Start by getting the President and CFO in one room to align - and then discuss if you should invest marketing resources 80/20, 70/30, or something else,” I suggested. “Sounds like you’ve got to do both, but maybe not equally. The MOST important is that you all agree on the model,” I encouraged.

Why Allocation Models Matter

An Allocation Model is the #1 framework I discuss most often with my CEO and CMO clients - in part because our lives are constant trade-offs of too many opportunities with too few resources. I regularly ask, "Is this a 50/50 priority? 80/20? 90/10?"

Being very clear, USING FIXED NUMBERS is one of the most important ways you can communicate the relative priority of strategy and align execution. Otherwise, every person on every team makes their own trade-offs. And that’s bad, very bad.

Whether you're leading a startup or a massive company, the ability to allocate resources effectively can be the difference between stunning success and scattered, conflicting efforts.

The concept is deceptively simple: if you had $100 or 100% effort to invest across initiatives, how would you spend it? The activity requires real trade-offs to stay in the fixed total. The exact numbers aren’t as important as the relative weight of options to one another. An 80/20 focus is MUCH different than 50/50.

The Power of Explicit Priorities At Every Level

Allocation models can be incredibly helpful at the C-suite level, communicating the corporate strategy's prioritization of regions, products, industries, audience focus, or any other factors.

Allocation models can and should cascade throughout an organization. Different departments may need their own allocation models - either to clarify their relative contribution to the corporate priority or to clarify trade-offs of their own sub-domains.

For instance, a product organization may over-allocate to the new products in development (70/30), while the marketing and sales orgs may need to allocate more to the existing products in market they can sell today (30/70). These allocation models can co-exist in a 50/50 or 60/40 corporate allocation as long as they are explicitly agreed upon between teams.

As another example, marketing teams might have allocation models for different approaches (i.e 60% demand gen, 20% awareness, 20% deal acceleration) or for content strategy (i.e. 25% financial buyer, 50% advocates, 25% influencers.)

The possibility for where to use allocations is endless. I even used it for my own time when I was an individual contributor. It is a helpful tool for every person on every team to seek clarity.

Beyond Revenue: Smart Allocation Factors

Financial expectations provide a great starting point for understanding the relative priority of efforts. For instance, your financial plan for next year probably details detail relative contributions:

Regional revenue may be 50% US, 30% EMEA, 15% APAC, 5% Rest of World

Product revenue may be 60% first product, 30% second, 10% third

Industry revenue may be 40% tech, 30% banking, 20% manufacturing…

Audience revenue may be 50% Enterprise, 30% Midmarket, 20% SMB

But whatever the starting ratio, revenue shouldn’t be the only factor. Allocation models should also take into consideration:

Growth Rates & Potential : A product generating 20% of revenue but growing twice as fast as other areas might deserve outsized investment

Market Opportunity: Emerging markets or technologies might justify greater resource allocation based on future potential

Strategic Importance or Risk: Some initiatives might be critical for future market position, warranting investment beyond their current revenue contribution. Perhaps you take into consideration mulit-year revenue and growth, or existential threat.

Competitive Opportunity: You may have a window of opportunity against a competitor and that requires a shift in investments in a significant way.

I generally start with revenue contribution for order of magnitude and then make adjustments based on growth and importance. I find that it’s a bit more art than science. But most important of all: —» Interdependent teams must forge agreement on relative priority.

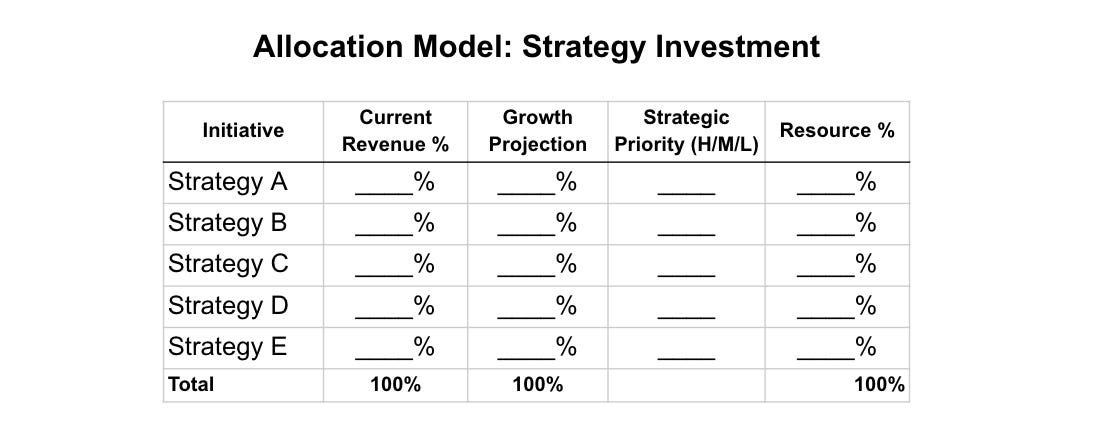

Here’s an example template that could be adjusted for different proiorities of the business:

The AI Imperative: Forcing Allocation Discussions

Allocations aren’t just about budget —they are about attention, talent, and organizational focus. In the current AI revolution, many people are grappling with how to properly prioritize new AI products and initiatives. I suggested using an allocation model framework. For some, AI is an existential crisis where product resources must flip from 70/30 core:AI to 30/70. These companies need to redefine themselves in the next 12 months to survive or die and must allocate much differently than their current revenue might suggest. For others, less so.

For some teams looking to become innovative using AI within their organization, a 10-15% “innovation time and effort” allocation may be sufficient. Other companies might see AI as a critical competitive differentiator and allocate double or triple % to changing processes and staff.

The numbers matter less than the clarity they provide. When a CEO declares that AI initiatives will receive 30% of company resources, different teams can align their efforts accordingly:

Product teams might allocate even more (40%?) to build ahead

Sales teams might maintain a higher focus on current revenue streams (10% allocation)

Marketing might split the difference to support both current business and future positioning

Don’t Spread the Peanut Butter Too Thin

When I ran Oracle’s awareness advertising, our leader was very clear: if you spread priorities too evenly across too many things, you don’t get much impact with any. Instead of funding many initiatives, we made focused, bold investments in a few things and (sometimes sadly) ignored many others. But the results were clear - our research showed more awareness, more preference, and more ROI for focus areas - you need an order of magnitude impact to cut through th enoise. “If you spread the peanut butter too thin, none of the bites are satisfying,” he taught. Later, we just quipped, “Peanut butter!” when asked to invest in everything.

Implementation Tips

The most effective leaders use allocation models not just as budgeting tools that a small subset of the company knows — but as communication devices that help align the entire organization around strategic priorities. A few tips:

Be Clear About Orders of Magnitude: Don't get lost in precise percentages. The difference between 40% and 42% matters less than the difference between 40% and 75%

GET ALIGNMENT - DON’T FEAR CONFLICT: The most important discussions are between trade-offs you don’t want to make. If two leaders of different groups have different priorities - every person on their teams could come into conflict. Many CEOs may shy away from conflict ‘hoping their teams will figure it out’ - but often, CEOs need to make a call so that the whole team can be in agreement and sprint in the same direction. Mature resolution up-front beats ongoing conflict in the trenches.

Reinforce Allocation Models Regularly: Once an allocation model is discussed and agreed upon, it should be repeated over and over so that the organization knows it, remembers it, and uses it for decision-making. Allocation models can change (especially quarter to quarter), but the value is having an ongoing decision framework vs. a one-time idea someone said once.

Communicate Context: Share the strategic thinking behind allocation decisions to help teams make aligned choices. The allocation models are a framework to assist, not handcuffs to constrain. Provide clear guidance and context and let teams make the best decisions they can in their area.

Monitor & Evolve: Watch how different teams interpret and implement the model, and adjust guidance as the market or company reality evolves.

The Bottom Line

In a world of infinite opportunities, the ability to create focus is crucial. Discussing priorities and context isn’t enough to guide day-to-day decisions and conflict. By using explicit allocation models with numerical clarity, the C-Suite can help their teams focus energy and resources where they'll make the greatest impact, together.

And remember: when everything is a priority, nothing is a priority.

What else?

Do you have any tips for allocation models I’ve missed? Please share!

Carilu Dietrich is a former CMO, most notably the head of marketing that took Atlassian public. She currently advises CEOs and CMOs of high-growth tech companies. Carilu helps leaders operationalize the chaos of scale, see around corners, and improve marketing and company performance.

Thanks- interesting

I work in ABM. We are used to priorizations (accounts and buyer persona/ decision makers) to work effectively

But it is never enough 😅

I've used allocation models to manage my own resource of time as an IC and have applied a similar approach to aligning budget with priorities. Where I have struggled is the right amount of priorities to have on the list for allocation. I like no more than three important priorities that need to happen in the next 12 to 18 months to achieve more immediate goals. For initiatives that may impact longer term outcomes beyond 18 months add no more than 2 more. But if there is a max number not to cross before impact is diminished I'd love to hear that theory. Helpful article.