Elevate Your Marketing Dashboard: How to Impress the CEO, CRO, and CFO

A Pro-Active Data Snapshot Can Help Everyone Focus on What Really Matters

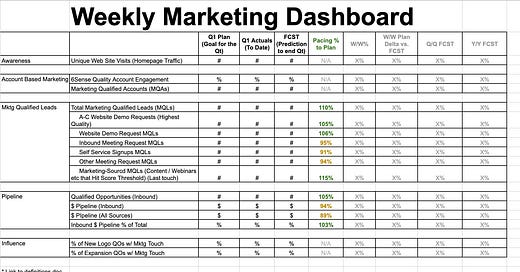

CMOs are under constant scrutiny from the board, the CEO, the CFO, and the CRO. So, how do marketing leaders share the right level of detail? It’s a skill. A few years back, I got a glimpse of the weekly marketing performance dashboard of Katrina Wong, former head of marketing for Segment. Katrina had a strong relationship with her CRO, Joe Morrissey, in part because Katrina’s numbers and contribution to the pipeline were so clear (and successful). Below is a version of the dashboard she shared with the C-Suite, Sales Leadership, and Marketing Leadership as an FYI and for analysis in the weekly pipeline meeting. Her team would compile the spreadsheet Monday morning. They would put a screenshot in a presentation deck along with a few bullets of highlights / lowlights of the week, plus quick summaries of upcoming campaigns, initiatives, or investigated concerns. They would send the deck out Monday afternoon as pre-reading for the Tuesday pipeline meeting with sales leadership. Katrina and the team followed this sales methodology of forecasting so sales would understand and respect it. They found that having the same operating rhythm went a long way in the partnership.

Download a spreadsheet template here for your team:

Put it in context!

The most important part of a dashboard is putting your numbers in context

Is this number good or bad?

Katrina’s dashboard provides multiple levels of context - how are we doing against the plan? How did we do last week? How did we do last week versus the plan? How did we do versus the last quarter and the same quarter last year? This dashboard can be quickly simplified by hiding columns or line items but it has all the critical data to help analyze marketing’s most important metrics quickly. Specifically, her columns were:

Q1 Plan - This is the original goal for the quarter

Q1 Actuals - This is the to-date # of what’s been achieved.

Forecast - This is a prediction of where they thought they would end the quarter based on the current trajectory - this column is a #

Pacing to plan % - this is the critical calculation of (Forecast / Plan ) = % — are you trending toward 83% attainment? 105%? What’s your prediction of where you will end the quarter based on where you are now? This is the most important column on the spreadsheet because any executive can understand it without understanding the specific numbers. Coloring these numbers on the chart to be red / yellow / green and bold makes them quickly stand out and directs the viewer’s attention. Some people make the mistake of using a % of the way to plan that’s based only on the results-to-date - but this is a mistake! Executives want to know if we will make the quarter, not that we’re just 28% at 33% of the way through the quarter. Don’t make them do mental math. Provide a forecast for the quarter based on the combinations of your results to date, plus a prediction of how you are pacing to get an overall prediction.

Week-over-week percentage (W/W %) - This shows how much the number went up from the week before. Are we trending in the right direction? Was it a flat week that should make us worry?

Week-over-week forecast delta (W/W Forecast Delta %) — This is the change in this week’s forecast over last week. For example, last week, we were forecasting 97% to goal; this week the forecast up to 99%, and now the delta is 2% week over week.

Quarter-Over-Quarter Forecast (Q/Q FCST)- What % greater or lesser is this quarter’s forecast versus last quarter? Are we growing 20% from last quarter? 5%?

Year-over-year Forecast (Y/Y FCST) - What % greater or lesser is this quarter’s forecast over last year’s same quarter last year? This is a particularly important comparison to seasonal companies. For instance, if you have a massive Q4 spike each year, Q1 might be 20% down from Q4, but 40% up from the same quarter last year.

Categories of Measurement

So, which numbers are most important to put into context? It can depend on the nature of your business and go-to-market model. Segment was mostly a sales-driven motion where marketing provided 60% of the pipeline and sales generated 30-40% of their own pipeline. The categories Katrina tracked included:

Pipeline - While listed in the middle of the chart, pipeline is the core of what the C-Suite cares about when talking to the CMO. It’s the brass tax of “Are we going to make this quarter and this year?” Many marketing teams debate whether to share units (#) or pipeline by dollars (You can't use 'macro parameter character #' in math mode. You can't use 'macro parameter character #' in math mode amount that will get the company to the revenue dollars. A weakness in either should be addressed and can be seen quickly in this weekly dashboard. This part of the dashboard could be quickly extracted for a board deck at the end of the quarter.

Awareness - Often, a board, CEO, CFO, CRO won’t care deeply about awareness numbers. But it is a leading indicator, and one you might want to share to show progress of awareness investments. Conversely, low growth in awareness can be a precursor to coming pipeline weakness. When I ran awareness advertising at Oracle, I paid $250,000 per year to do a global market survey to measure awareness progress against our target audience. At Atlassian, I mainly used unique homepage visits as a much cheaper proxy for our awareness. We could see lifts in some of our bigger awareness spending and building word-of-mouth. Katrina also tracked unique website visits to the homepage.

Account-Based Marketing - Segment used 6Sense for their ABM initiatives and tracked the # of Quality Account Engagements and the # of Marketing Qualified Accounts. I have seen other CMOs share % of Target Accounts engaged as well, or instead.

Marketing Qualified Leads (MQLs)- You wouldn’t necessarily want to share these with the board unless they are doing a deep dive, but in the weekly pipeline meeting with the CRO, you might break down overall MQLs and some specific sub-categories that are most important to the business. Katrina highlighted several to her leadership team in order of highest to lowest conversion rate: the highest quality account Website demo requests, other website demo requests, inbound meeting requests, self-service signups, other meeting requests, and lastly, lower converting content leads that met a score threshold. Website Demo Request MQLs would convert at 20x Content MQLs, so it was critical to track the success of these most valuable MQLs. At Segment, she had goals for these sub-categories that laddered up to the overall goals and plans to hit the revenue numbers. At Segment, Katrina used LAST TOUCH attribution to track marketing-sourced leads. While she would look at first, last, and multi-touch to answer different questions for their business, she found last-touch to be the most effective model for attributing marketing sourcing of new leads.

Influence - This category is important to share to show the impact of marketing on engaging with contacts and accounts to help salespeople accelerate deals and close bigger deals - especially for companies with big Account-Based Marketing investments. While sourcing deals was a big goal of Katrina’s, she also wanted to show how much marketing was engaging with and supporting deals across both new and expansion revenue.

Get Definitions Aligned With Sales

One important aspect of getting sales to trust your dashboard is getting clear and explicit alignment around definitions of leads, pipeline, sales stages, pipeline $ estimates or rules etc. Katrina had tight alignment on these definitions - so her numbers were analyzed for insights instead of questioned for validity.

Why isn’t this a Salesforce Dashboard?

I see many marketing executive dashboards in Salesforce - but Salesforce lacks some contextualization to goals and pacing that Katrina found useful for giving a bird’s-eye view of her most important data. She provided links to some reports in Salesforce, but her team compiled a version of this dashboard each week outside of Salesforce in a spreadsheet. This spreadsheet was also manually compiled because of the complexity of the data sources, collaboration with finance, and the use of additional tools in addition to Salesforce.

What was in Segment’s Dashboard Tech Stack?

As I walked through Katrina’s dashboard with her, I was interested in what software her team had been using to compile all of these numbers. Here are some quick highlights: Salesforce - CRM & pipeline, People.AI - Rep performance, Clari - Forecasting, Marketo - marketing automation, Leandata - routing, Full Circle - attribution, Lookr - data analysis, Google Docs for spreadsheets & presentations

Do you need a weekly C-Suite dashboard?

I see many marketing teams that have dashboards on dashboards to help them analyze and drive performance. Marketers need to look at many more categories than are represented here to run their business effectively. But as we share outside of marketing, we need to constantly be pruning back to the essence of what matters most to the outside audience. We need to put those key numbers in context. Most importantly, we need to proactively share critical high-level performance metrics to keep the CEOs, CFOS, and CROs from coming spelunking in marketing data - if they don’t know how things are going, they might come deep diving and distracting the team.

I was immensely impressed with Katrina’s dashboard when I first saw it because it had both a short list of what was most important to Segment and enough context to help her quickly show what was working and what needed improvement. Katrina had some great relationships with her sales counterparts over the years, in part because they so clearly knew how she was tracking and developed deep trust with her over her insights into what could actually move the pipeline numbers to keep their sales teams fed.

What would you change about this dashboard? How does this stack up against highlights you would share with the C-Suite?

Carilu Dietrich is a former CMO, most notably the head of marketing that took Atlassian public. She currently advises CEOs and CMOs of high-growth tech companies. Carilu helps leaders operationalize the chaos of scale, see around corners, and improve marketing and company performance.

Could you provide a little more details/example around the Influence bucket? And what type of mktg touch is included (assuming multi-touch here with a certain lookback window). It's an interesting grouping but I imagine most deals would have a mktg touch.

Great share + love that the message is to push more visibility with leadership. The biggest recommendation I have here is to set the expectation early that this is for visibility and not to make knee-jerk reactions to weekly fluctuations. B2B growth is NOT linear. Seasonality is real. AEs focus on closing deals at end of quarter vs. creating new pipeline. Lots of variables at play.

Excellent communication tool + way to build trust, but not a course-correcting mechanism at the weekly level.